Understanding the intricacies of the superannuation system specifically super details for employers is crucial to fulfilling your obligations and supporting your employees’ financial well-being. In this blog, we will delve into the essential superannuation details every employer should know, providing valuable insights and practical guidance to help you navigate this complex landscape effectively. Read on to why super details for employers like you are important and what you need to know to stay compliant with Australia’s superannuation laws.

What is employer superannuation?

As an employer, there are certain super details you need to know to ensure you are complying with Australian employment laws. Super, short for superannuation, is a compulsory retirement savings scheme that provides financial security for employees. All employers in Australia are required to make super contributions for their eligible employees. However, there are complex rules and regulations that you need to be aware of to avoid any potential legal issues.

Obligations as an Employer

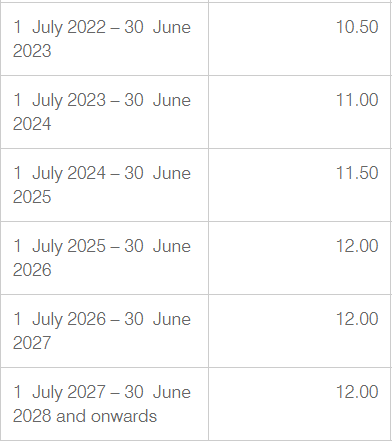

It is your responsibility to understand your super obligations. The Superannuation Guarantee (SG) is the minimum super contribution you must make for your eligible employees. The scheduled SG rate are as follows and are calculated on an employee’s ordinary time earnings (OTE). OTE includes most payments made to an employee, such as wages, commissions, allowances, and bonuses. However, it does not include overtime payments or some types of leave, such as sick leave or maternity leave.

You can check the current SG rate with the Australian Taxation Office (ATO) as it is subject to change.

Know Who is Eligible

Prior to June 30, 2022, employers were required to contribute to the Superannuation Guarantee (SG) only for employees who earned $450 or above (pre-tax) in a given month.

As of July 1, 2022, the monthly earnings threshold was eliminated, resulting in employers being obliged to make contributions for nearly all their employees.

It is important to keep track of employee earnings to ensure you are complying with your obligations. It is also your responsibility as an employer to ensure that your employees are eligible to receive contributions from the superannuation fund.

Choose a Super Fund

Employers are required to provide their eligible employees with a choice of super fund. However, you are not required to offer a choice if the employee is covered by a certified agreement, is a member of a defined benefit fund, or has a temporary visa. If an employee does not choose a super fund, then you need to select a default fund. You can choose a fund that suits your needs, but it must be a complying fund, meaning it meets certain Australian Prudential Regulation Authority (APRA) standards.

Make Contributions on Time

It’s important to meet key deadlines for superannuation payments to avoid penalties and legal action. As an employer, you will need to make quarterly superannuation payments to your employees’ accounts. These payments must be made within 28 days of the end of each quarter.

– 28 October for July to September

– 28 January for October to December

– 28 April for January to March

– 28 July for April to June

Failing to meet these deadlines can result in fines, penalties and in extreme cases, legal action.

Reporting and Keeping Records

As an employer, you need to keep accurate records of your SG contributions. You must keep copies of all super contributions made, as well as any agreements made with your employees regarding super contributions. You must also keep records of the choice of super fund given to your employees. These records must be kept for at least five years and be made available for inspection upon request by the Australian Taxation Office

Conclusion

By equipping yourself with a thorough understanding of super details for employers, you can fulfill your obligations as an employer while fostering a positive working environment and securing your employees’ financial futures. Ensure that you are up to speed on super details for employers including obligations, types of contributions, key deadlines, employee eligibility, and reporting and record-keeping requirements to avoid any non-compliance penalties. The most significant responsibility that comes with running a successful business is ensuring that you are compliant with all laws and regulations.

Remember, the superannuation landscape is ever-evolving, so understanding super details for employers, staying updated with the latest regulations and seeking professional advice when needed is crucial. If you ever find yourself feeling too overwhelmed, don’t hesitate to turn to a dedicated team of professionals such as the Wardle Partners Accountants and Advisors for advice. We understand the complexities of running a business in Australia – let us help you get the right advice so that you can build a successful business without worries. Contact us today for a free consultation.